Locating Official Announcements: When Does Teladoc Health Inc Earnings Come Out

Teladoc Health, like all publicly traded companies, utilizes specific channels to disseminate its earnings announcements. Understanding these channels ensures investors and stakeholders receive timely and accurate information. These official channels provide a reliable source for financial data, minimizing the risk of misinformation from unofficial sources.

Finding Teladoc Health’s official earnings announcements involves checking their investor relations website and subscribing to their alerts. This proactive approach ensures you are among the first to know when the next earnings report is released. Furthermore, knowing where to find past reports allows for a thorough analysis of the company’s financial performance over time.

Teladoc Health’s Official Announcement Channels, When does teladoc health inc earnings come out

Teladoc Health primarily uses its investor relations website and press releases to announce its earnings. The investor relations section of their website is meticulously designed to provide comprehensive financial information. Press releases are typically distributed through prominent financial news outlets and are also mirrored on the company’s investor relations page. This dual approach ensures widespread dissemination of the crucial financial information.

Subscribing to Email Alerts and RSS Feeds

Most investor relations websites offer the option to subscribe to email alerts or RSS feeds. To subscribe to email alerts, typically, you will find a registration form on the investor relations section of Teladoc Health’s website. This form usually requires providing an email address and selecting the types of alerts you wish to receive, such as earnings announcements, press releases, or SEC filings. RSS feeds offer a similar functionality, allowing you to automatically receive updates through an RSS reader. This ensures that you receive immediate notification when new earnings reports are released.

Finding Past Earnings Reports on the Teladoc Health Investor Relations Site

Locating past earnings reports on the Teladoc Health investor relations site is a straightforward process. Generally, these reports are organized chronologically under a section titled “Financial Reports,” “SEC Filings,” or a similar designation. The reports are often available in PDF format, allowing for easy download and review. Within each report, you will typically find details such as revenue, earnings per share, and key financial metrics. Navigation on the site is typically intuitive, using a search function can also help in quickly locating specific reports. For example, searching for “10-K” or “10-Q” will typically yield the company’s quarterly or annual reports.

Reliable Third-Party Sources for Teladoc Health Earnings

While the company’s website is the primary source, several reputable third-party sources often report Teladoc Health’s earnings. These include major financial news outlets such as the Wall Street Journal, Bloomberg, Reuters, and Yahoo Finance. These sources usually provide summaries of the earnings announcement, along with analyst commentary and stock market reaction. It’s important to note that while these sources are generally reliable, always cross-reference information with the official announcements from Teladoc Health to ensure accuracy.

Visual Representation of Earnings Data

Visual representations are crucial for understanding the complex financial data of a company like Teladoc Health. Charts and tables effectively communicate trends and comparisons, allowing for a quicker grasp of the company’s performance than raw numerical data alone. The following sections illustrate Teladoc Health’s financial performance using various visual methods.

Teladoc Health’s Earnings Per Share (EPS) Trend (Past Five Years)

A line graph would best illustrate Teladoc Health’s EPS over the past five years. The x-axis would represent the fiscal year (e.g., 2019, 2020, 2021, 2022, 2023), and the y-axis would represent the EPS in dollars. Each data point would represent the EPS for that particular year. The line connecting the points would visually depict the trend – whether EPS has increased, decreased, or remained relatively stable over time. Ideally, the graph would include a clear title, axis labels, and a legend if multiple data series were included (for example, if comparing actual EPS to projected EPS). A noticeable upward or downward trend would immediately communicate the overall health of the company’s profitability. For instance, a consistent upward trend would suggest growing profitability, while a downward trend might indicate challenges. Note: Actual EPS data would need to be sourced from Teladoc Health’s financial reports.

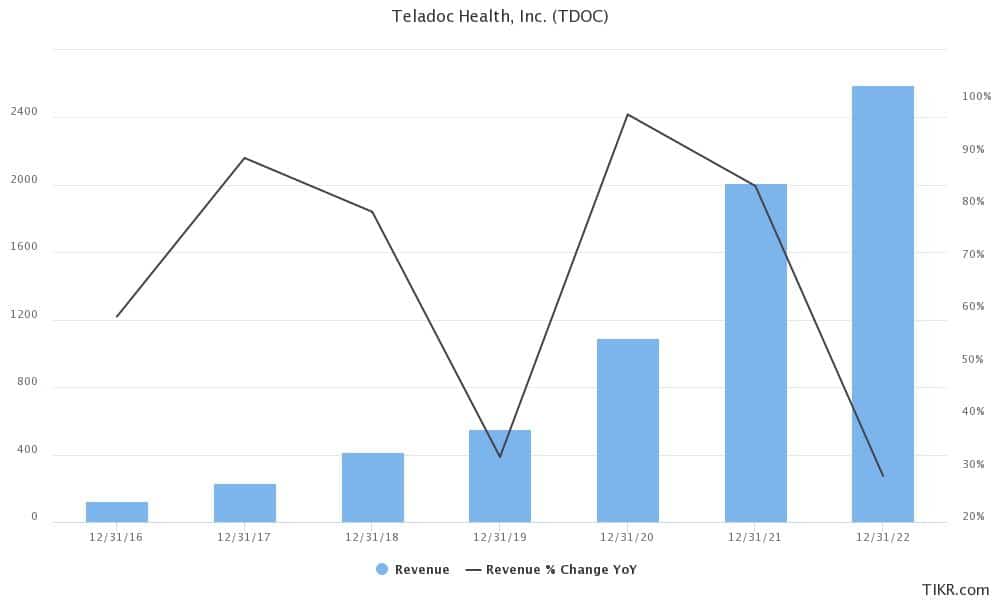

Comparison of Teladoc Health’s Revenue Growth with Major Competitors

The following table compares Teladoc Health’s revenue growth with that of its major competitors over a specified period (e.g., the past three years). A four-column layout is used for optimal readability on various screen sizes. The first column would list the company name (Teladoc Health and its competitors), the second column would show the revenue for the starting year, the third column would show the revenue for the ending year, and the fourth column would present the percentage change in revenue over the period. This allows for a direct visual comparison of revenue growth across companies. The table should include a clear title specifying the period covered and the units of revenue (e.g., millions of US dollars).

| Company | Starting Year Revenue | Ending Year Revenue | Revenue Growth (%) |

|---|---|---|---|

| Teladoc Health | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 1 | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 2 | [Insert Data] | [Insert Data] | [Insert Data] |

| Competitor 3 | [Insert Data] | [Insert Data] | [Insert Data] |

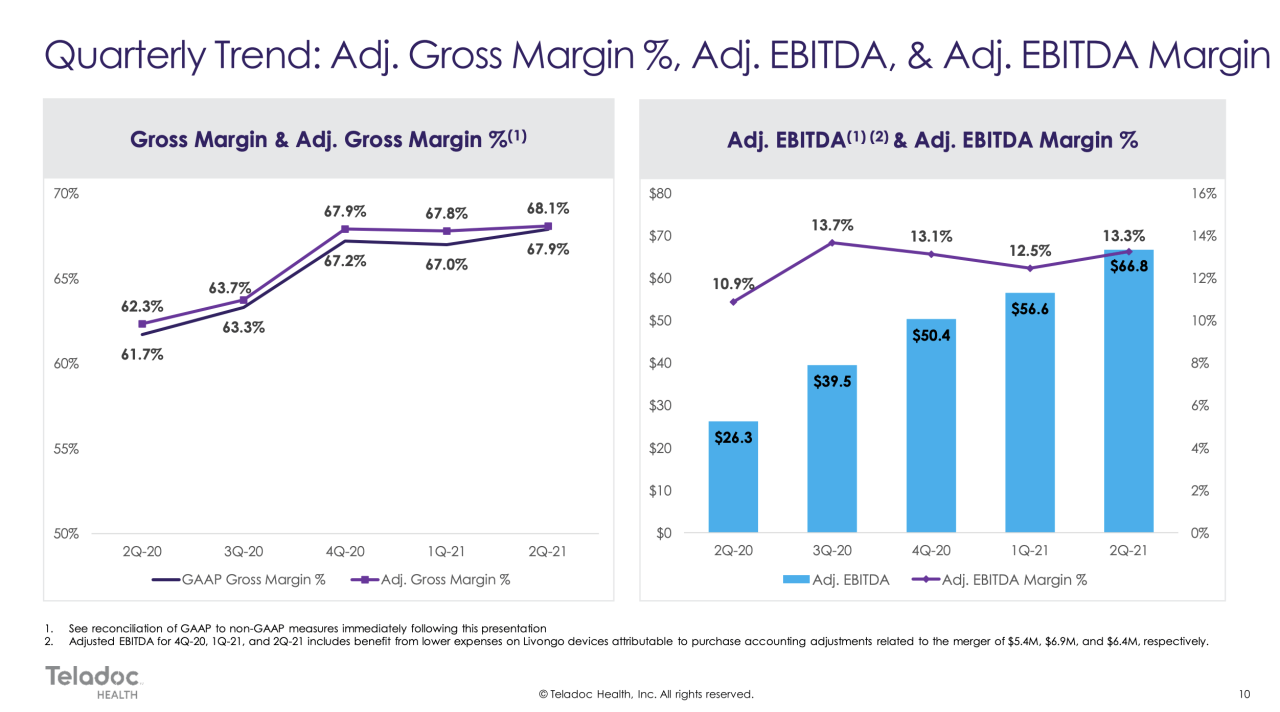

Visual Representation of Key Financial Ratios (Past Three Years)

A series of bar charts would effectively represent key financial ratios over the past three years. Each chart would focus on a single ratio.

- Gross Profit Margin: A bar chart showing the gross profit margin (Gross Profit / Revenue) for each year. Higher bars would indicate better profitability.

- Operating Margin: A bar chart displaying the operating margin (Operating Income / Revenue) for each year. Similar to gross profit margin, higher bars indicate better operational efficiency.

- Net Profit Margin: A bar chart illustrating the net profit margin (Net Income / Revenue) for each year. This represents the overall profitability after all expenses.

- Debt-to-Equity Ratio: A bar chart depicting the debt-to-equity ratio (Total Debt / Total Equity) for each year. This shows the company’s financial leverage.

Each chart would have a clear title indicating the ratio and the units (percentage for margins, ratio for debt-to-equity). The x-axis would represent the year, and the y-axis would represent the value of the ratio. Comparing the bars across years would immediately show trends in each ratio. For example, a consistently increasing debt-to-equity ratio might signal increasing financial risk.

Tim Redaksi