Understanding Pet Insurance Cancellation Policies

Cancelling pet insurance can seem straightforward, but the specifics vary significantly depending on your provider and the circumstances surrounding your cancellation. Understanding the intricacies of cancellation policies is crucial to avoid unexpected fees or disruptions in your pet’s healthcare coverage. This section will clarify typical processes, highlight differences between providers, and examine common cancellation scenarios and their financial implications.

Typical Pet Insurance Cancellation Process

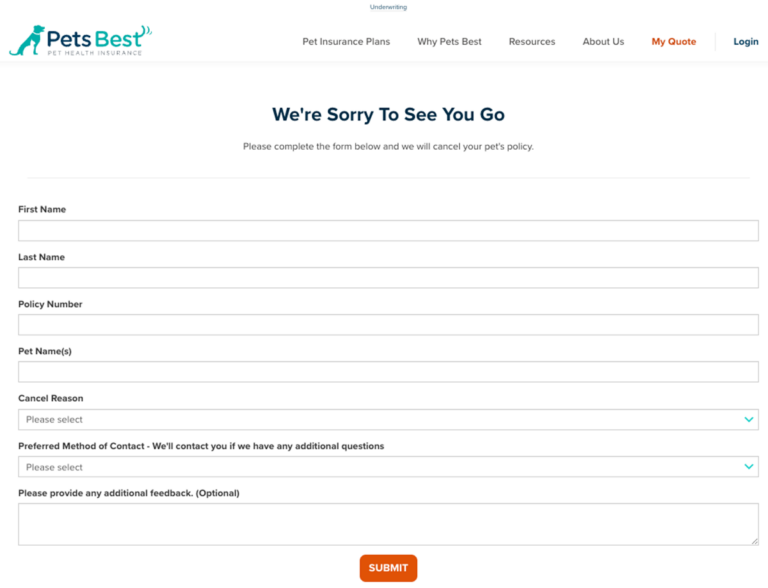

Most pet insurance providers allow policyholders to cancel their coverage at any time. The process usually involves contacting the provider directly, either by phone or through their online portal. You’ll typically need to provide your policy number and reason for cancellation. Following this, the provider will confirm your cancellation and Artikel any applicable fees or refunds. It’s advisable to obtain written confirmation of the cancellation to avoid any future disputes. Some providers may require a formal written notice sent via mail, while others might accept cancellations via email or phone. Always check your policy documents for the specific cancellation procedure.

Variations in Cancellation Policies Across Providers

Pet insurance providers differ considerably in their cancellation policies. Some companies may impose a cancellation fee, while others may not. The amount of the fee, if any, can vary significantly depending on factors like the length of your policy, the reason for cancellation, and the specific terms Artikeld in your individual policy contract. Furthermore, refund policies also vary. Some providers might offer a pro-rata refund (a refund based on the unused portion of your premium), while others may only refund a portion of your premium or none at all. Always carefully review the terms and conditions of your specific policy before signing up.

Common Reasons for Cancellation and Associated Implications

Several common reasons prompt pet owners to cancel their pet insurance. These include moving to a new area with different veterinary care options, changing to a different provider offering better coverage or lower premiums, the pet reaching an age where coverage becomes less cost-effective, or simply due to financial constraints. The implications of cancelling vary. While some cancellations might result in no financial penalty, others may lead to cancellation fees, forfeiting a potential refund, or a gap in coverage that could leave you responsible for unexpected veterinary bills.

Comparative Analysis of Cancellation Fees

Cancellation fees and refund policies can greatly influence your decision to switch providers or cancel coverage. Below is a sample table comparing these aspects for a few hypothetical providers (Note: These are illustrative examples and do not represent actual provider policies. Always check directly with the insurance company for the most up-to-date information).

| Provider | Cancellation Fee | Refund Policy | Notice Period |

|---|---|---|---|

| PetSure Plus | $50 | Pro-rata refund of unused premium | 30 days |

| Healthy Paws | $0 | No refund | None |

| Figo Pet Insurance | Variable, based on policy length | Pro-rata refund less a processing fee | 14 days |

| Embrace Pet Insurance | $25 | Partial refund (up to 50% of unused premium) | 30 days |

Circumstances Permitting Cancellation

Pet insurance policies, while designed for long-term coverage, sometimes necessitate early cancellation. Understanding the circumstances under which you can cancel without penalty is crucial to avoid unexpected financial burdens. Several factors influence whether a provider will grant a cancellation request without imposing fees or penalties.

While most pet insurance providers expect policyholders to commit to a longer-term plan, they do acknowledge that life throws curveballs. Certain unforeseen events can justify an early cancellation request. Providing clear and comprehensive documentation is key to supporting your claim. The more evidence you can provide to substantiate your reason, the higher your chances of a successful cancellation without penalty.

Situations Allowing Penalty-Free Cancellation

Several situations might allow for the cancellation of a pet insurance policy without incurring penalties. These typically involve significant life changes or unforeseen circumstances beyond the policyholder’s control. Providing supporting documentation, such as medical records or relocation papers, strengthens the cancellation request.

- Relocation outside the provider’s coverage area: Moving to a region where the insurer doesn’t operate necessitates cancellation. Proof of relocation, such as a change of address confirmation from the post office or a new lease agreement, is sufficient documentation.

- Financial hardship: A significant and documented financial downturn, such as job loss supported by official documentation from an employer, can be a valid reason for cancellation. The insurer might require proof of unemployment benefits or financial assistance.

- Death of the insured pet: This is the most straightforward reason for cancellation. A copy of the veterinary certificate confirming the pet’s death typically suffices.

- Provider’s significant policy change: If the insurance provider makes substantial changes to the policy terms and conditions, making the policy significantly less favorable, you might have grounds for cancellation without penalty. A detailed comparison of the old and new policy terms should be presented.

- Provider’s breach of contract: If the insurance company fails to fulfill its obligations as Artikeld in the policy agreement, such as denying valid claims without justifiable reason, this could warrant cancellation. Documentation of the denied claims and communication with the provider is crucial.

Required Documentation for Cancellation Requests

To support your cancellation request, gather relevant documentation proving the reason for cancellation. This proactive approach increases the likelihood of a successful and penalty-free cancellation. Failure to provide adequate documentation may result in the insurer refusing your request or imposing penalties.

- Proof of relocation: Change of address confirmation, new lease agreement, or utility bills with a new address.

- Proof of financial hardship: Layoff notice, unemployment benefits documentation, or bank statements showing significant financial strain.

- Veterinary certificate: Official documentation confirming the pet’s death.

- Policy comparison document: Highlighting significant changes made by the provider to the policy terms and conditions.

- Correspondence with the provider: Emails, letters, or other communication documenting denied claims or other breaches of contract.

Cancellation and Refunds

Cancelling your pet insurance policy and receiving a refund involves several steps and considerations. The process varies depending on the insurer, your policy terms, and the timing of your cancellation. Understanding these factors is crucial to ensure a smooth and informed experience.

Can i cancel pet health ins – Requesting a refund typically begins with contacting your pet insurance provider. Most companies have a dedicated customer service line or online portal for managing policy changes. You’ll need to clearly state your intention to cancel and request a refund. Be prepared to provide your policy number and other identifying information. The insurer will then process your cancellation request and determine the amount of any refund you are eligible for.

Refund Calculation

Several factors influence the final refund amount. The primary factor is the time elapsed since your last payment. Policies often operate on a monthly or annual payment schedule. If you cancel mid-term, you will generally only receive a pro-rata refund for the unused portion of your coverage period. Any premiums already used to cover claims or administrative fees will be deducted. Furthermore, some insurers may impose cancellation fees. It’s crucial to carefully review your policy’s specific terms and conditions regarding refunds. For example, if you paid $600 annually and cancelled after six months, a pro-rata refund might be $300, minus any claims paid and potential cancellation fees.

Comparison of Refund Policies

Refund policies differ significantly across pet insurance providers. Some companies offer more generous refund options than others. For instance, Company A might offer a full refund within a specific cancellation window (e.g., 30 days), while Company B might only provide a pro-rata refund less administrative fees regardless of the cancellation timing. It’s advisable to compare the cancellation and refund policies of several insurers before selecting a plan to understand what to expect should you need to cancel your coverage. Always read the fine print! Always request the specific details of the refund policy in writing from the insurer before purchasing a policy.

Refund Request Flowchart

The following flowchart illustrates the typical steps involved in obtaining a refund after cancelling your pet insurance policy:

Step 1: Contact Insurer – Initiate contact via phone or online portal.

Step 2: Submit Cancellation Request – Clearly state intention to cancel and request refund. Provide policy details.

Step 3: Confirmation of Cancellation – Receive confirmation of cancellation from the insurer.

Step 4: Refund Calculation – Insurer calculates refund based on policy terms, time elapsed, and claims paid.

Step 5: Refund Disbursement – Receive refund via specified method (e.g., check, direct deposit).

Step 6: Review Refund – Verify the amount received matches the calculated refund.

Alternatives to Cancellation: Can I Cancel Pet Health Ins

Cancelling your pet’s insurance policy might seem like the only option when facing rising premiums or dissatisfaction with coverage, but exploring alternatives could save you money and maintain valuable protection. Often, modifying your existing plan is a more practical and beneficial solution than complete cancellation. This section Artikels several options to consider before making a final decision.

Before contacting your provider, carefully review your current policy and your pet’s needs. Consider factors like your pet’s age, breed, health history, and your budget. Understanding these factors will help you make informed decisions about potential adjustments.

Plan Adjustments for Cost Savings

Modifying your pet insurance plan can significantly reduce premiums without sacrificing essential coverage. Several adjustments can achieve this, depending on your insurer’s offerings. These include reducing your annual coverage limit, opting for a higher deductible, or switching to a less comprehensive plan.

Reducing your annual coverage limit means lowering the maximum amount your insurer will pay out in a year. This is a viable option if your pet is generally healthy and you’re primarily concerned about unexpected accidents rather than extensive long-term illnesses. Increasing your deductible, the amount you pay out-of-pocket before your insurance kicks in, is another effective way to lower premiums. A higher deductible means lower monthly payments, but you’ll pay more when you need to file a claim. Finally, switching to a less comprehensive plan, such as one with limited coverage for routine care, can also lead to significant cost savings. Weigh the benefits of comprehensive coverage against the potential cost savings before making this decision.

Comparing the Benefits of Different Plan Adjustments

The ideal plan adjustment depends on your individual circumstances. For example, a healthy, young pet might benefit from a higher deductible and a lower annual limit, resulting in substantial premium reductions. Conversely, an older pet with pre-existing conditions might require a more comprehensive plan with a lower deductible, even if it means higher premiums. Each adjustment offers a different balance between cost and coverage. Carefully analyze your pet’s health history and potential future needs to determine the most appropriate modification. For instance, a cat with a history of urinary tract infections might benefit from keeping broader coverage for this specific condition, even if it means a slightly higher premium.

Communicating with Insurance Providers to Negotiate Plan Changes

Contacting your insurance provider directly is crucial for exploring plan modifications. Clearly explain your financial constraints and your desire to adjust your plan rather than cancel it entirely. Many insurers are willing to work with their clients to find solutions that meet both parties’ needs. Be prepared to discuss specific adjustments you’re considering, such as increasing your deductible or reducing your annual limit. Politely and firmly express your willingness to explore options and find a mutually agreeable solution. Document all communications, including emails and phone calls, to maintain a record of your interactions. A well-prepared and polite approach can significantly increase your chances of successfully negotiating a more affordable plan.

Illustrative Examples of Cancellation Scenarios

Understanding pet insurance cancellation policies often involves navigating various scenarios. Some cancellations are straightforward, while others can lead to disputes or penalties. The following examples illustrate common situations pet owners may encounter.

Successful Cancellation Without Penalty

A pet owner, Sarah, purchased a six-month pet insurance policy for her new kitten, Mittens. After five months, Mittens remained healthy, and Sarah decided the cost of the insurance was no longer justifiable. She contacted her insurer well within the policy’s grace period, as stipulated in her contract. The insurer confirmed the cancellation, and Sarah received a prorated refund for the remaining month, with no additional fees. This successful cancellation highlights the importance of carefully reviewing the policy’s terms and conditions regarding cancellation periods and refund policies.

Cancellation with Penalties Due to Early Termination

John purchased a year-long pet insurance policy for his dog, Buster. After only three months, John decided to switch to a different provider, believing it offered better coverage. However, John’s policy included a clause stipulating early cancellation penalties. As a result, John had to pay a significant cancellation fee, losing a portion of his already paid premium. This scenario underscores the financial implications of prematurely terminating a pet insurance policy, especially those with early cancellation penalties.

Hypothetical Cancellation Dispute, Can i cancel pet health ins

Imagine this: Maria purchased a pet insurance policy for her elderly cat, Whiskers, with a reputable company. Whiskers unfortunately fell ill, and Maria incurred significant veterinary bills. After submitting a claim, the insurer denied coverage, citing a pre-existing condition clause Maria believed was not properly explained during the policy purchase. Frustrated and facing substantial debt, Maria attempted to cancel her policy, requesting a full refund due to the insurer’s alleged misrepresentation. The insurer refused, citing the terms and conditions of the contract. This led to a lengthy dispute, potentially requiring mediation or legal action to resolve. This example showcases the importance of clear communication and a thorough understanding of policy terms, and demonstrates how disputes can arise when coverage is denied or the cancellation process is not clearly defined.

Illustrations of Cancellation Scenarios

One illustration depicts a pet owner meticulously reviewing their policy document, highlighting clauses related to cancellation, refunds, and grace periods. The scene emphasizes the importance of understanding the policy’s fine print before initiating a cancellation request. The pet owner’s expression is one of focused concentration, emphasizing the need for careful consideration. Another illustration depicts a calm and professional conversation between a pet owner and an insurance representative. The representative is explaining the cancellation process and associated fees, while the pet owner listens attentively, showing the importance of open communication and clear explanations during the cancellation process. A third illustration shows a frustrated pet owner arguing with an insurance representative over a denied refund. The scene illustrates the potential for disputes and highlights the need for clear communication and policy understanding. Finally, a fourth illustration depicts a pet owner happily receiving a prorated refund after successfully canceling their policy without penalty, highlighting a positive outcome.

Tim Redaksi