Cost and Premium Information: What Is Viva Health Rmc Insurance

Understanding the cost of Viva Health RMC insurance is crucial before enrollment. Several factors influence your premium, and it’s important to consider these to get an accurate estimate and compare it to other similar plans. This section details the factors affecting your premium, methods for estimating costs, and available payment options.

Factors Influencing Viva Health RMC Insurance Premiums, What is viva health rmc insurance

Numerous factors determine your Viva Health RMC insurance premium. These factors are often interconnected and can significantly impact the final cost. Key considerations include age, location, chosen plan (e.g., individual vs. family), pre-existing conditions, smoking status, and the level of coverage selected. For example, a younger, non-smoking individual living in a low-risk area and choosing a basic plan will generally pay less than an older smoker with pre-existing conditions living in a high-risk area and opting for comprehensive coverage.

Estimating the Cost of Viva Health RMC Insurance

Accurately estimating the cost requires inputting specific details into Viva Health RMC’s online quoting tool or contacting their customer service. However, a general estimation can be made by considering the factors mentioned above. For instance, let’s consider two hypothetical individuals: Individual A (30 years old, non-smoker, basic plan, low-risk area) might estimate a monthly premium around $200, while Individual B (60 years old, smoker, comprehensive plan, high-risk area) could expect a monthly premium closer to $800. These are illustrative examples only and should not be taken as precise figures. Actual premiums will vary based on individual circumstances. The best way to obtain an accurate estimate is to use the official Viva Health RMC quoting tools or speak with a representative.

Comparison with Other Similar Plans

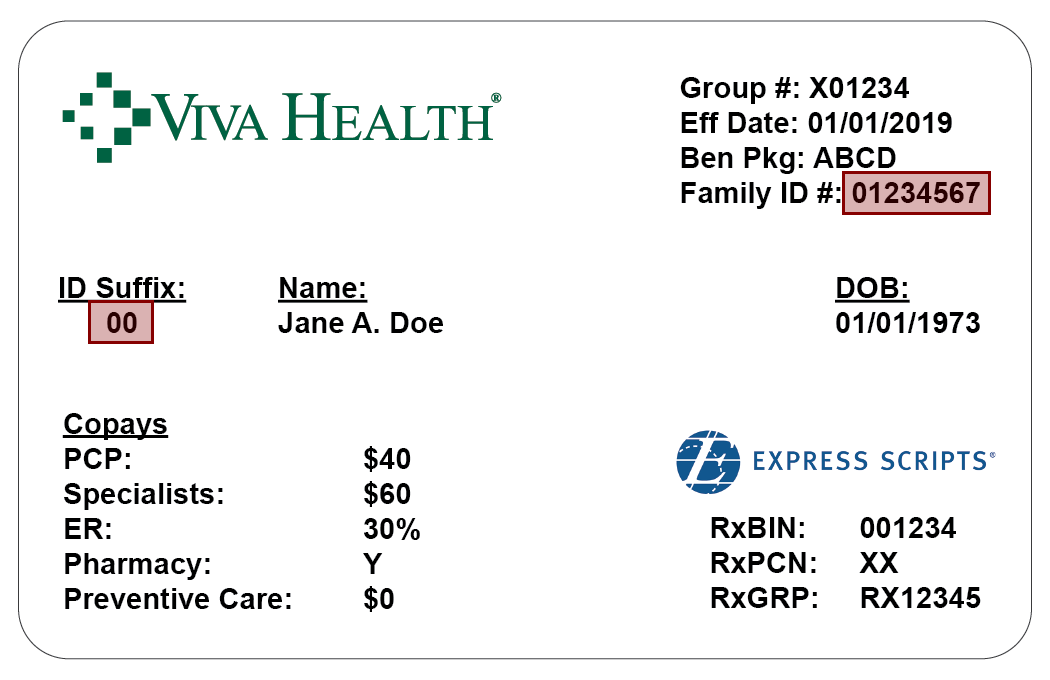

Comparing Viva Health RMC insurance with similar plans requires research into competitor offerings. Factors to compare include premium costs, coverage details (deductibles, co-pays, out-of-pocket maximums), network size, and customer service reputation. Websites that compare health insurance plans can be helpful resources. Remember to focus on the total cost of care, considering premiums, deductibles, and out-of-pocket expenses. Direct comparisons should only be made between plans with similar coverage levels.

Payment Options for Premiums

Viva Health RMC likely offers several convenient payment options for premiums. These typically include direct debit from a bank account, credit card payments, and possibly mail-in checks. Some plans might allow for monthly installments, while others may require annual or semi-annual payments. Specific payment methods and options should be confirmed directly with Viva Health RMC. It is advisable to inquire about any available payment plans or discounts for prompt payment.

Tim Redaksi