Financial Reporting and Transparency for Self-Funded Health Plans

Self-funded health plans, unlike fully insured plans, bear the direct financial responsibility for their members’ healthcare costs. This necessitates robust and transparent financial reporting to ensure the plan’s solvency and the accurate assessment of its financial health. Effective financial reporting is crucial for responsible plan management, informed decision-making, and maintaining trust among plan participants.

Financial Reporting Methods in Self-Funded Plans

Self-funded plans utilize various methods for financial reporting, often tailored to their specific needs and size. Common practices include maintaining detailed records of all claims paid, tracking administrative expenses, and regularly generating financial statements. These statements typically include balance sheets, income statements, and cash flow statements, providing a comprehensive overview of the plan’s financial position. Larger self-funded plans may employ sophisticated accounting software and engage professional actuaries to assist with financial modeling and forecasting. Smaller plans may rely on simpler accounting systems, potentially utilizing spreadsheets or less complex software solutions. Regardless of size, the core principle remains consistent: meticulous record-keeping and accurate financial reporting are paramount.

Importance of Transparency in Financial Reporting

Transparency in financial reporting is essential for building trust and confidence among plan participants. Openly sharing financial information, such as claims data, administrative expenses, and investment performance, allows participants to understand how their contributions are being used and the overall financial health of the plan. This transparency fosters accountability and encourages informed participation in plan governance. Furthermore, transparent reporting can help attract and retain employees, as it demonstrates responsible financial management. A lack of transparency, conversely, can breed suspicion and erode trust, potentially leading to negative consequences.

Consequences of Non-Compliance with Reporting Requirements

Non-compliance with reporting requirements can result in a range of penalties and negative consequences. These may include financial penalties, legal action from regulators, and reputational damage. Failure to accurately report financial information can lead to misallocation of resources, inadequate funding, and ultimately, the insolvency of the plan. In addition, non-compliance can expose the plan sponsor to legal liability and potential lawsuits from participants. The severity of the consequences will vary depending on the nature and extent of the non-compliance, as well as the applicable regulations. For example, a failure to accurately report contributions could lead to penalties from the IRS.

Accurate Financial Reporting and Plan Sustainability

Accurate financial reporting is vital for the long-term sustainability of a self-funded health plan. By providing a clear and accurate picture of the plan’s financial position, it enables proactive management of expenses, identification of trends, and informed decision-making regarding plan design and benefits. This proactive approach can help prevent unexpected financial shortfalls and ensure the plan’s ability to meet its obligations to participants. For instance, accurate reporting can reveal rising healthcare costs, allowing the plan sponsor to implement cost-containment strategies before a crisis arises. Similarly, accurate data on utilization patterns can inform benefit design decisions, optimizing plan benefits while managing costs. Regular analysis of financial reports facilitates effective risk management and contributes to the long-term financial health and stability of the self-funded plan.

Illustrative Example: Do Self-funded Health Plans File Annual Naic Forms

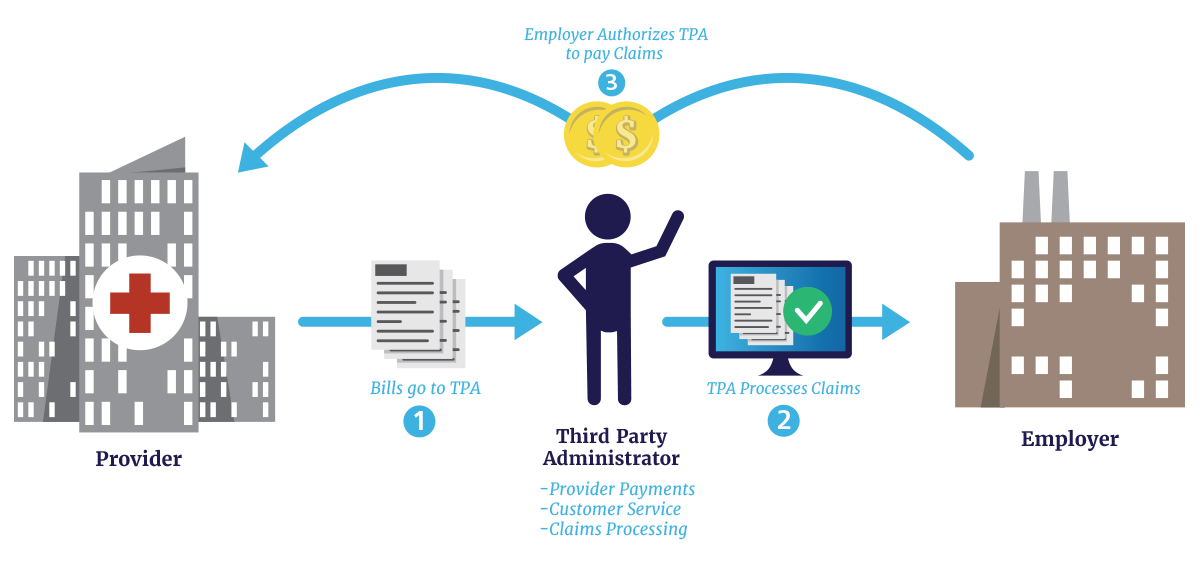

Let’s consider “Acme Corporation,” a mid-sized manufacturing company with 500 employees. Acme self-funds its employee health benefits, meaning it directly pays for covered medical expenses instead of purchasing insurance from a commercial carrier. This example will illustrate the financial aspects of Acme’s self-funded plan and its interaction (or lack thereof) with NAIC reporting.

Acme’s self-funded plan operates with a dedicated trust fund holding approximately $2 million in assets. These assets consist primarily of liquid investments intended to cover anticipated medical claims. Liabilities include outstanding claims that haven’t yet been processed, estimated at $500,000. Acme’s claims experience over the past three years shows a relatively stable pattern, with annual claims costs averaging $1.2 million. This stability allows for accurate budgeting and financial planning.

Acme Corporation’s Financial Reporting

Acme, as a self-funded plan, is not subject to NAIC reporting requirements. Unlike fully insured plans, self-funded plans are not considered insurance companies and therefore don’t file the annual statements required by the NAIC. However, Acme maintains detailed financial records of its health plan, including income and expenses, assets and liabilities, and claims data. This internal reporting is crucial for managing the plan’s financial health and making informed decisions about benefit design and cost containment strategies. This internal reporting often follows generally accepted accounting principles (GAAP) to ensure accuracy and transparency within the company.

Impact of Regulatory Changes on Acme’s Financial Stability, Do self-funded health plans file annual naic forms

While not directly subject to NAIC regulations, Acme’s self-funded plan can still be indirectly affected by changes in the healthcare regulatory landscape. For instance, changes to federal laws regarding minimum essential health benefits (MEHBs) could impact the types and costs of services Acme must cover, potentially increasing claims costs. Similarly, changes to tax laws affecting employer-sponsored health plans could influence the overall financial burden on Acme. These indirect effects highlight the importance of proactive financial planning and risk management for self-funded employers. For example, a significant increase in the cost of prescription drugs might necessitate a review of the formulary or a shift to a higher deductible plan to mitigate the financial impact. The company could also explore strategies like wellness programs to encourage preventative care and reduce long-term healthcare costs.

Tim Redaksi